India’s sustainability landscape is entering a decisive decade, driven by tightening global carbon regulations, evolving ESG disclosure standards, decarbonization technologies, AI-enabled reporting, and growing demand for product-level carbon transparency. For Indian corporates, these trends are no longer optional; they directly influence market access, cost of capital, and long-term competitiveness.

As a specialist in green buildings, ESG, and decarbonization, Conserve Consultants partners with businesses to anticipate these shifts, strengthen compliance, and unlock new value from sustainability initiatives.

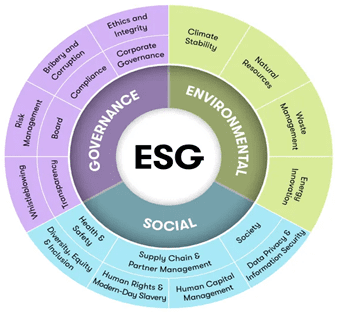

1. ESG Moving into Core Business Strategy

ESG has evolved from a “reporting exercise” to a core business imperative that shapes strategy, risk management, and financial performance. Indian companies that embed ESG into decision-making are seeing tangible benefits in profitability, resilience, reputation, and stakeholder trust.

Conserve supports this transition by linking ESG priorities with business KPIs, integrating sustainability into capital expenditure decisions, and designing implementation roadmaps that deliver measurable ROI.

2. Rise of Product-Level Carbon Disclosure (PCF / EPD)

Global buyers, green building projects, and OEMs increasingly demand product-level carbon footprints and Environmental Product Declarations (EPDs) as a precondition for business. For exporters and materials manufacturers, PCF has shifted from “good-to-have” to “must-have” for market access, especially in sectors exposed to global climate policies and border carbon measures.

Conserve helps manufacturers and suppliers quantify product footprints, develop EPDs, and align with green building and global buyer requirements, turning transparency into a differentiation lever.

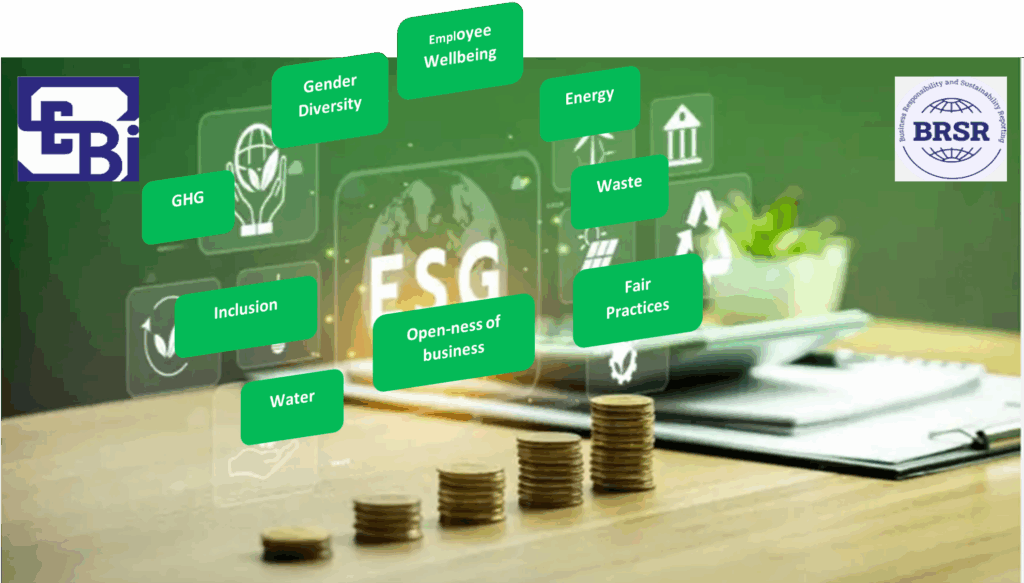

3. Value-Chain ESG Assessments Becoming Contractual

Large Indian corporates now expect their value-chain partners to disclose emissions, workforce and safety data, and resource performance, driven by SEBI’s BRSR Core requirements and global platforms like EcoVadis. ESG has become part of procurement criteria, and suppliers that cannot provide credible data risk losing strategic accounts.

Conserve enables both anchor companies and suppliers to respond with robust baseline assessments, ESG questionnaires, and improvement plans that meet buyer expectations while strengthening internal systems.

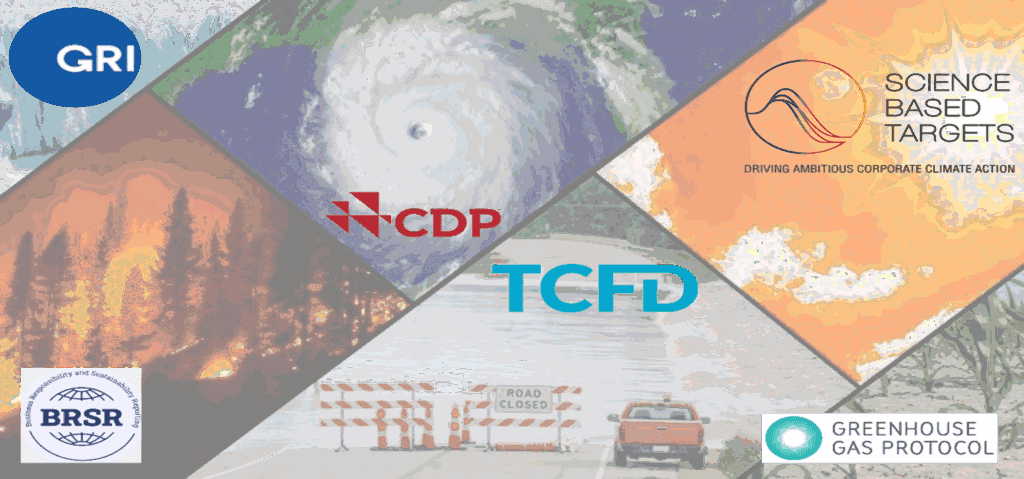

4. Interoperability of ESG Reporting Frameworks

With multiple frameworks (BRSR, GRI, ISSB, CDP, sector-specific questionnaires), businesses need integrated data systems rather than siloed reporting exercises. Leading Indian companies are prioritizing materiality alignment, harmonized indicators, and technology-led data consolidation to reduce duplication and compliance fatigue.

Conserve works with clients to map reporting requirements, streamline indicators, and design ESG data architectures that can serve multiple frameworks from a single, reliable source of truth.

5. Global Carbon Pressures and Evolving Indian Carbon Markets

Carbon intensity is rapidly becoming a pricing and competitiveness factor in global trade, pushing Indian exporters to measure and reduce product-level emissions. In parallel, India’s Carbon Credit Trading Scheme (CCTS) is evolving into a national carbon market that will increasingly cover hard-to-abate sectors and integrate compliance with voluntary actions.

Conserve helps businesses quantify emissions, identify abatement levers, and prepare for participation in carbon market mechanisms, ensuring they stay competitive as carbon becomes a cost line.

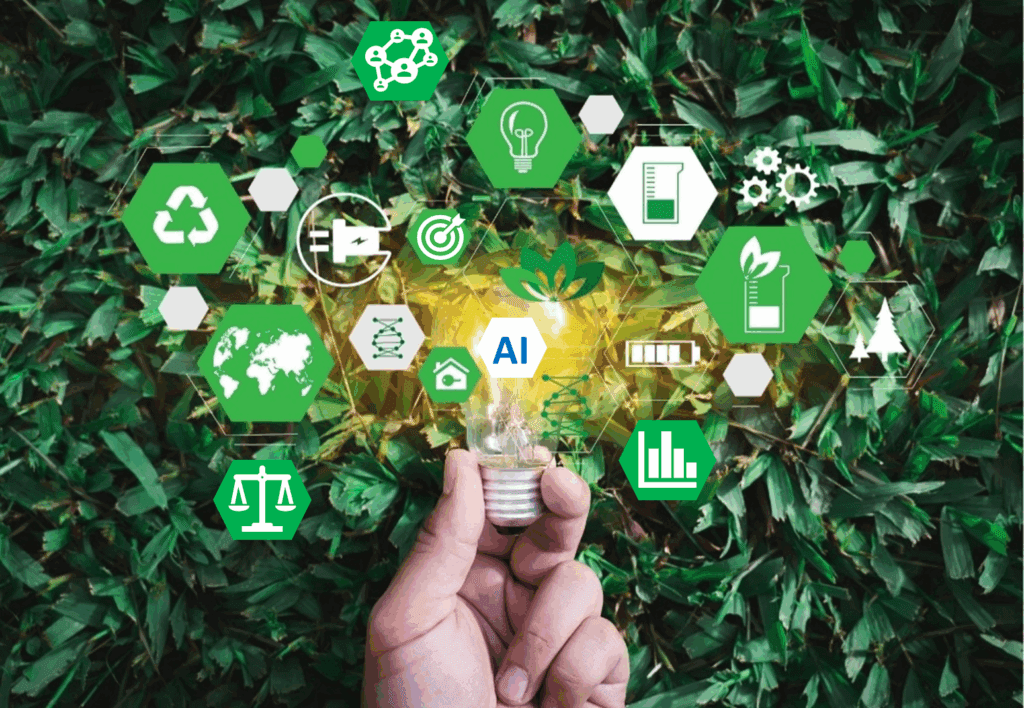

6. AI-Driven Sustainability and Digital Reporting Platforms

Annual, static ESG reports are giving way to continuous, data-driven sustainability management powered by automation and AI. Real-time dashboards, anomaly detection, and predictive insights are enabling faster decarbonization decisions and more accurate, audit-ready disclosures.

Conserve collaborates with technology partners to design digital ESG architectures where AI handles processing and pattern recognition, while human expertise validates insights and shapes strategy.

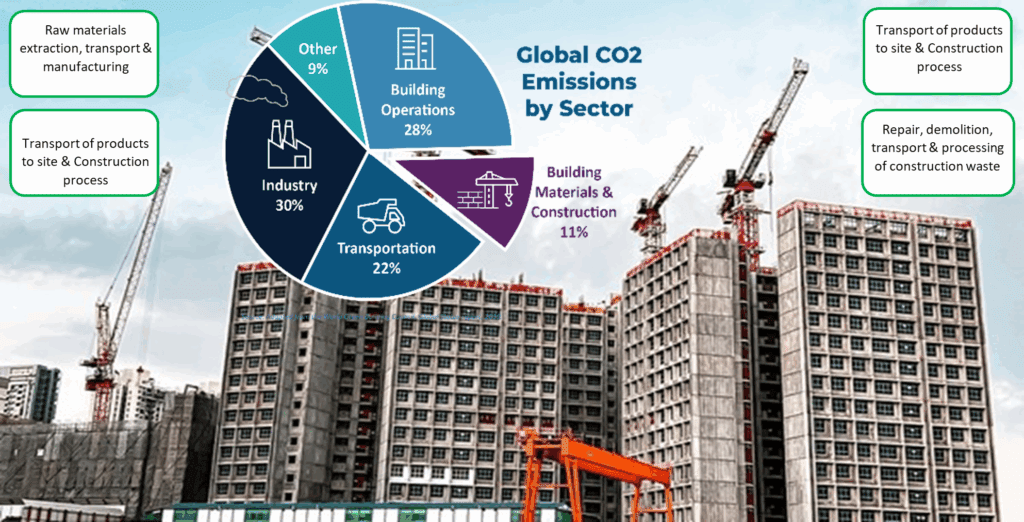

7. Embodied Carbon in Buildings Gaining Traction

The Indian real estate market is increasingly focused on embodied carbon—emissions from raw material extraction, manufacturing, transport, construction, and end-of-life. Developers and asset owners are now seeking material EPDs and whole-building Life Cycle Assessments (LCAs), supported by green building rating updates and new codes like ECSBC and upcoming NBC 2025 provisions.

As a pioneer in green building and LCA services, Conserve supports developers, architects, and product manufacturers with embodied carbon assessments, low-carbon design strategies, and compliance with Indian and international rating systems.

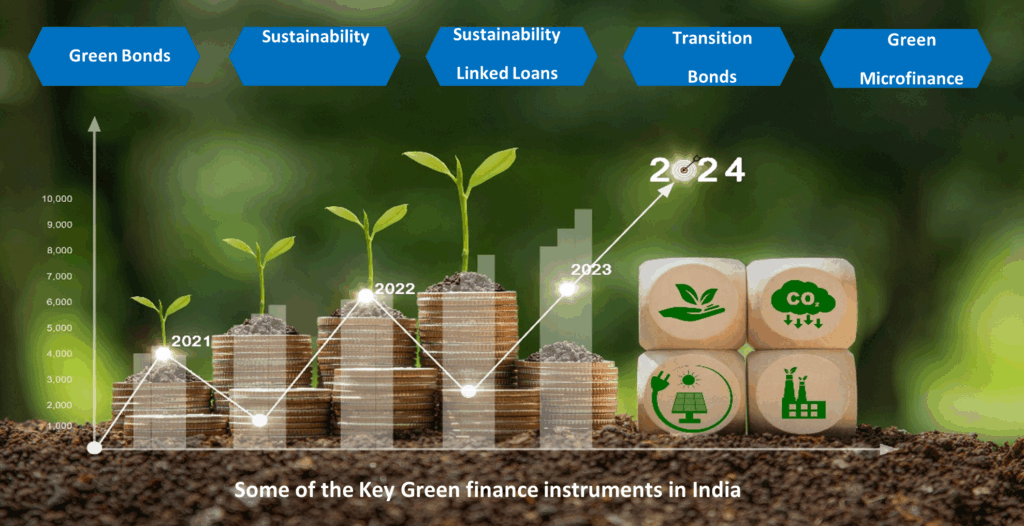

8. Surge in Green Finance and Sustainability-Linked Lending

India is seeing rapid growth in green bonds, sustainability-linked loans, transition bonds, and green microfinance, reinforced by SEBI’s 2025 draft transition finance taxonomy. Lenders are increasingly tying borrowing costs to ESG performance, rewarding credible decarbonization plans and improvements in energy, emissions, and water metrics.

Conserve helps clients build bankable sustainability roadmaps, define KPIs, and generate credible data that align with green finance requirements in sectors such as clean energy, real estate, transport, and agriculture.

9. ESG Assurance and Data Validation Becoming Critical

ESG in India is shifting from voluntary disclosure to assurance-grade, audit-ready reporting, driven by SEBI’s tightening BRSR regime. By FY 2026–27, thousands of companies will come under an expanded ESG assurance framework, making data quality, governance, controls, and traceability non-negotiable.

Conserve supports organizations in building robust ESG data governance processes, checks, and documentation that can stand up to independent assurance and align ESG practices with the rigor of financial reporting.

10. Rapid Rise of Climate Disclosures

Climate-related disclosures are moving from voluntary initiatives to mandatory global and local regulations, enabling investors to compare climate risk and transition readiness across companies. Indian firms are cascading expectations down their supply chains and aligning with frameworks such as SBTi, CDP, GRI, and ISSB to meet investor and customer pressure.

Conserve works with businesses to develop climate strategies, set science-aligned targets, and build disclosure capabilities that communicate both current performance and credible transition pathways.

How Conserve Consultants Can Help

These 10 trends are converging to redefine how Indian businesses grow, compete, and access capital, and they demand a structured, technology-enabled, and data-driven approach to ESG. Conserve Consultants brings deep expertise in sustainability strategy, green buildings, decarbonization, and ESG reporting to help organizations move from compliance-driven responses to proactive, value-creating sustainability programs.