Over the past year, 2025, our work across ESG consulting, carbon accounting, building sustainability, and product-level disclosures has reinforced one clear insight:

Sustainability is no longer about ESG frameworks. It’s about decisions and the data that enables them. What once felt fragmented is now starting to connect, and insights below explore where sustainability is truly heading:

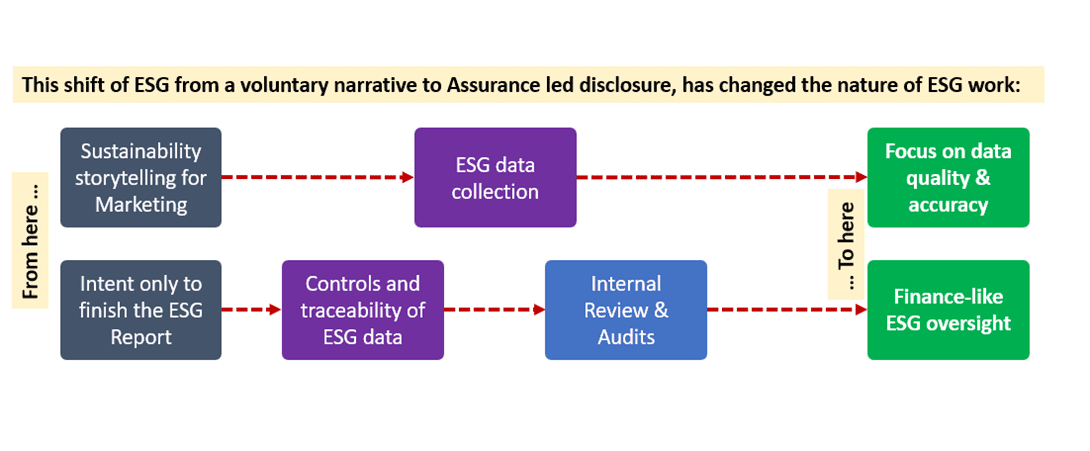

ESG has moved from just Narrative to Assurance

ESG is no longer a communications function; it is a management system. BRSR: What began as a voluntary ESG disclosure, then a structured mandatory reporting for a few listed companies, has now entered an assurance-led phase, with BRSR Core requiring third-party verification for an expanding list of companies as per SEBI guidelines.

Carbon Accounting is the backbone of ESG

Across nearly every engagement, Standards like GHG Protocol, ISO 14064, and ISO 14069 are no longer “optional best practices”. These are becoming the minimum entry point for credible sustainability strategies.

Whether in the context of BRSR Core disclosures, GRESB asset‑level performance, Net Zero commitments, CBAM readiness, Green finance eligibility, or corporate Sustainability Reports, robust carbon accounting has consistently emerged as the foremost priority.

Carbon accounting is no longer confined to the organisation-level

One of the biggest transitions this year has been the move from corporate carbon footprints to:

Product Carbon Footprints (PCF), Building-level Whole Life Carbon (WLC), Embodied carbon assessments

A single building-level LCA or product PCF can unlock multiple outcomes compliance, certification, ESG disclosure, cost optimisation, and long-term decarbonisation planning. What used to be separate efforts: LCA, PCF, ESG reporting, green certifications, are now interconnected outcomes of one robust carbon intelligence exercise.

Double Materiality is changing strategy conversations

Another important evolution has been the adoption of double materiality, not as a matrix for reporting requirement, but as a strategic decision-making framework.

Materiality & Double Materiality Assessments, aligns stakeholder expectations with financial risk, prioritises ESG investments, connects sustainability to enterprise-level risk management, provides clarity for boards and leadership.

Technology Is Quietly Becoming the Enabler

Behind all of this sits an often-overlooked layer: technology. Digital ESG platforms, LCA tools, and automated data workflows are becoming essential not to replace expertise, but to enable consistency, traceability, and scale.

Manual spreadsheets are challenging when it comes to BRSR Core assurance, Scope 3 value-chain reporting, Building LCAs, EPDs and PCFs at scale, multi-framework alignment for ESG disclosures; Hence, digitalization of ESG platform is a booming solution.

Conclusion: Sustainability is no longer about doing more frameworks. It’s about doing fewer things & doing them deeply, rigorously, and in a way that creates multiple business outcomes. Carbon accounting, building LCA, PCF, ESG strategy, and disclosure are no longer separate conversations. They are becoming one integrated system of decision-making.